Act NOW before the £1M Investment Allowance ends

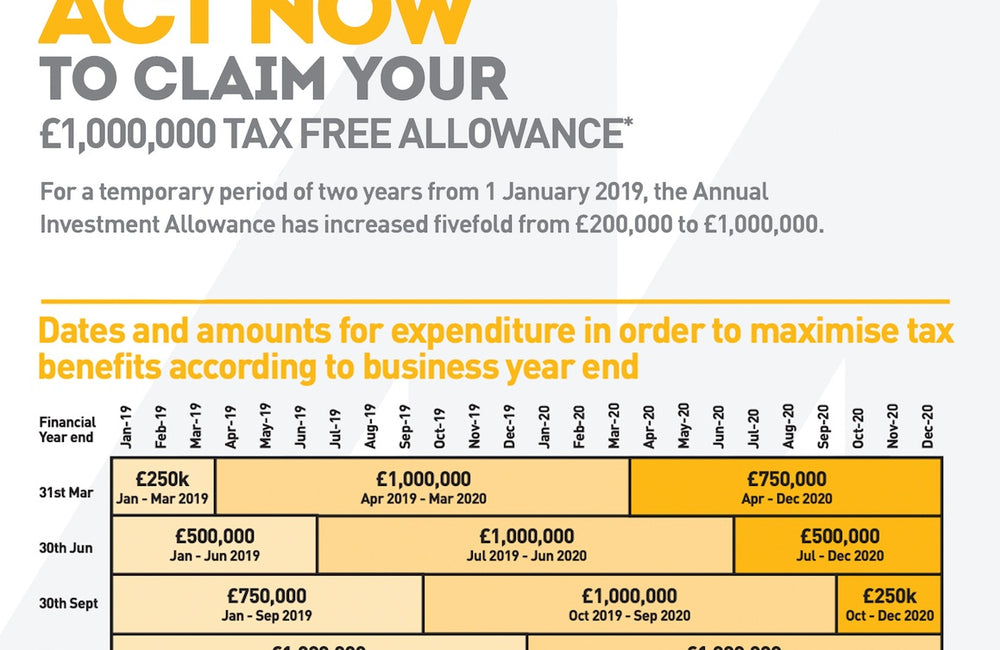

For a temporary period of two years from 1st January 2019, the Annual Investment Allowance (AIA) has increased fivefold from £200,000 to £1,000,000.

How can you benefit?

The higher AIA is particularly good news for small and medium-sized businesses.

How does it work?

The AIA is designed to give 100% first-year tax relief on qualifying expenditure for plant and machinery.

Simply put, a business with profits before tax of anywhere up to £1,000,000 can reduce its income/corporation tax bill to zero by purchasing new equipment of the same value.

This initiative is designed to give a financial incentive to investing profits back into your business.

What plant & machinery is eligible for AIA?

Luckily all the plant and machinery for sale at Chippindale Plant is included.

Can I finance equipment and still claim the AIA?

Yes, but not every lease qualifies so make sure it is the right type of agreement.

We can provide finance solutions for you that qualify however.

When does it end?

On the 1st January 2021, the AIA will drop back down to £200,000 so businesses should consider making capital purchases before then to gain maximum tax relief.

What if I'd like to take advantage of AIA before it runs out?

Let us know what equipment you'd be interested in and any questions regarding the AIA, via the 'Enquire Now' function on the website.

This will then be forwarded to the Director of Sales and we'll come back with a keen quote, along with any further information and help.